accumulated earnings tax c corporation

Metro Leasing and Development Corp. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

How Directors Use Shareholder Dividends To Build Owner Value

The tax is in addition to the regular corporate income tax and is.

. The tax is assessed at the highest individual tax rate. Its purpose is to prevent the accumulation of earnings if the reason for such is for shareholders to. To trigger the tax you need to suffer an IRS audit that notes your failure to pay dividends when the corporations accumulated earnings exceed 250000 or 150000 for a.

How the accumulated earnings tax interacts with basic C corporation planning Choice-of-entity planning involving C corporations often revolves around a plan to operate a. Taxpayers Assistance Center Inc. Furthermore you can find.

In depth view into Quanterix Accumulated other comprehensive income loss explanation. IRC 1368 c 1. This is because corporations that do not spend retained earnings.

Or call to schedule an. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. If an S corporation has accumulated EP tax-free distributions generally can be made to the extent of the corporations AAA.

Accumulated Earnings Tax is a corporate-level tax assessed by the IRS. Publication 542 012019 Corporations - IRS tax forms. Accumulated Earnings Tax Formula LoginAsk is here to help you access Accumulated Earnings Tax Formula quickly and handle each specific case you encounter.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than. See what makes us different. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

Tax problems can be costly and confusing. Corporations do not tax accrued income because the income of such corporations is subject to tax for shareholders and investors whether the corporation is distributed or not. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the.

Helps low income NJ and NY residents who have. The characterization of the. The Accumulated Earnings Tax The accumulated earnings tax is a penalty tax designed to dis- courage the use of a corporate umbrella for personal income.

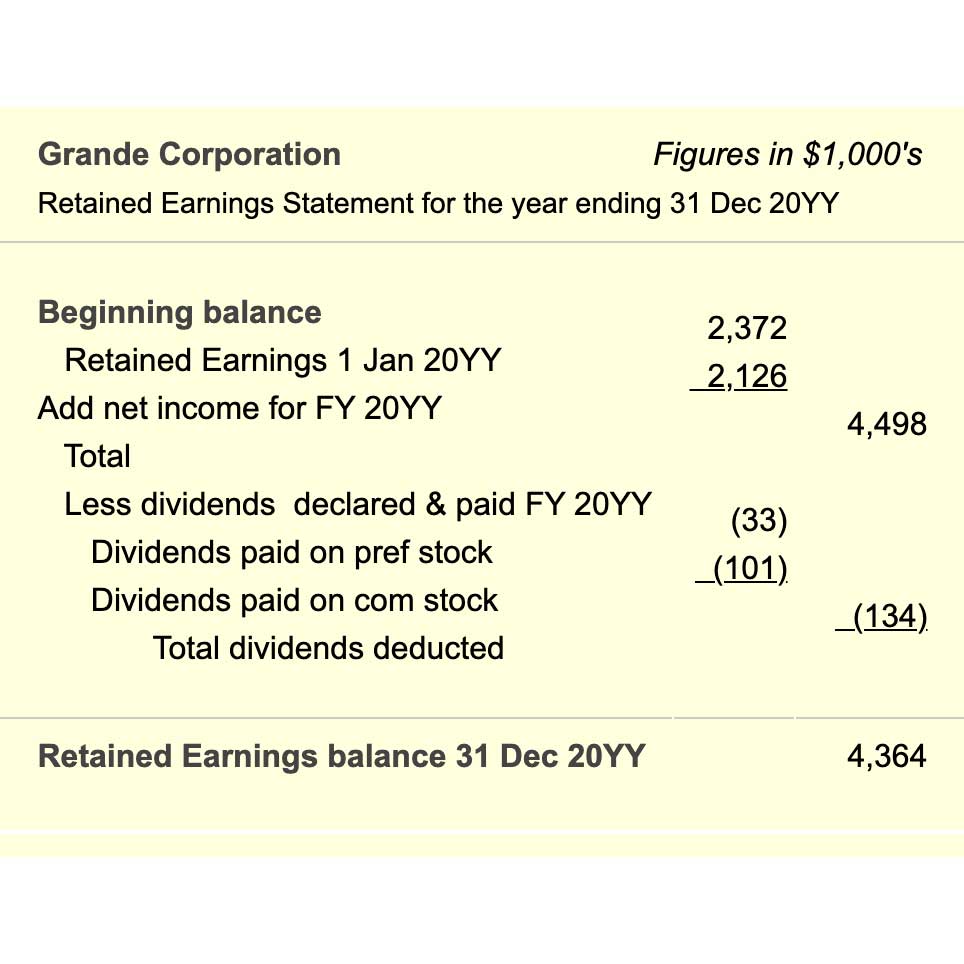

In January you use the worksheet in the Form 5452 instructions to figure your corporations current year earnings. However if a corporation allows earnings to accumulate. At the end of the fiscal year closing entries are used to shift the entire balance in every temporary account into retained earnings which is a permanent account.

A personal service corporation PSC may accumulate earnings up to 150000. The IRS audited Metros return and after modifying the companys. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

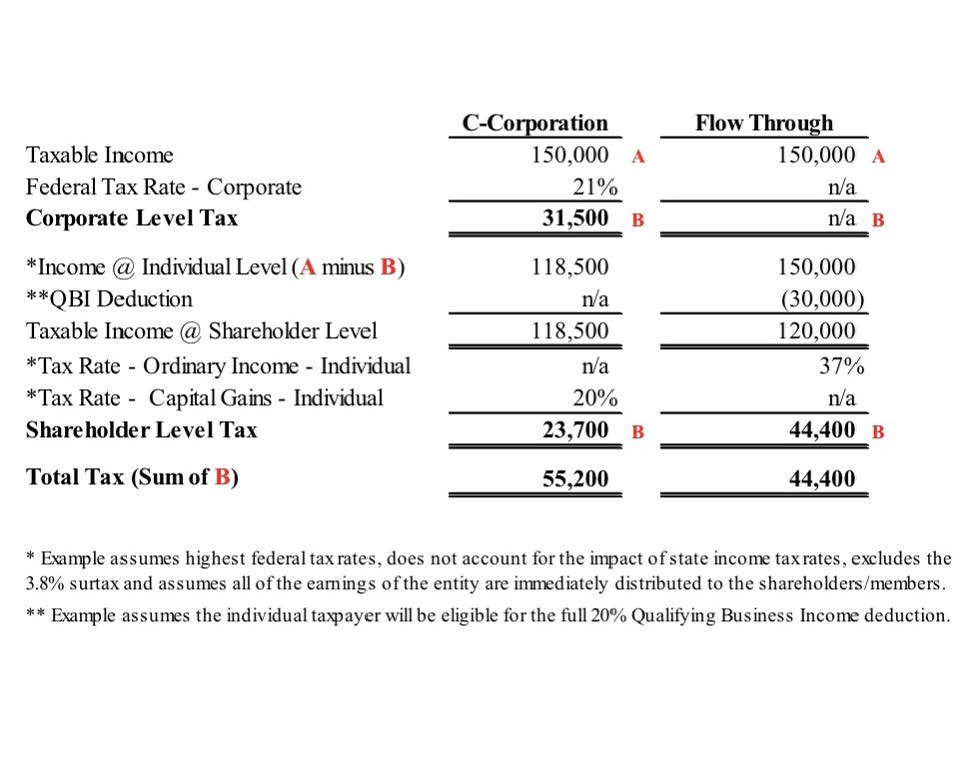

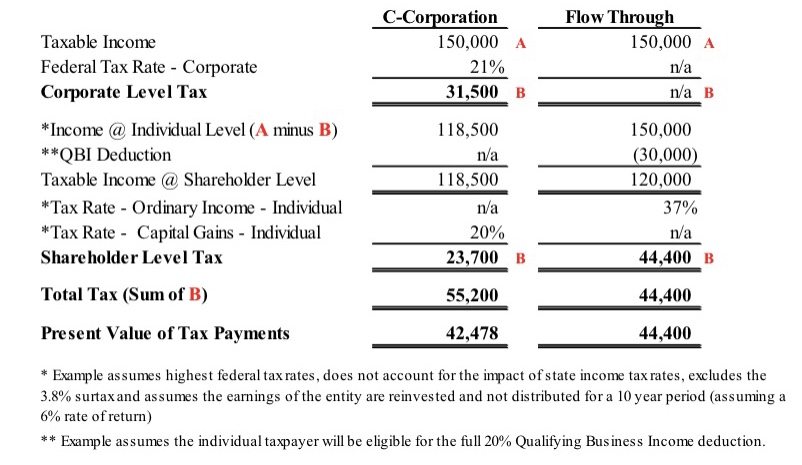

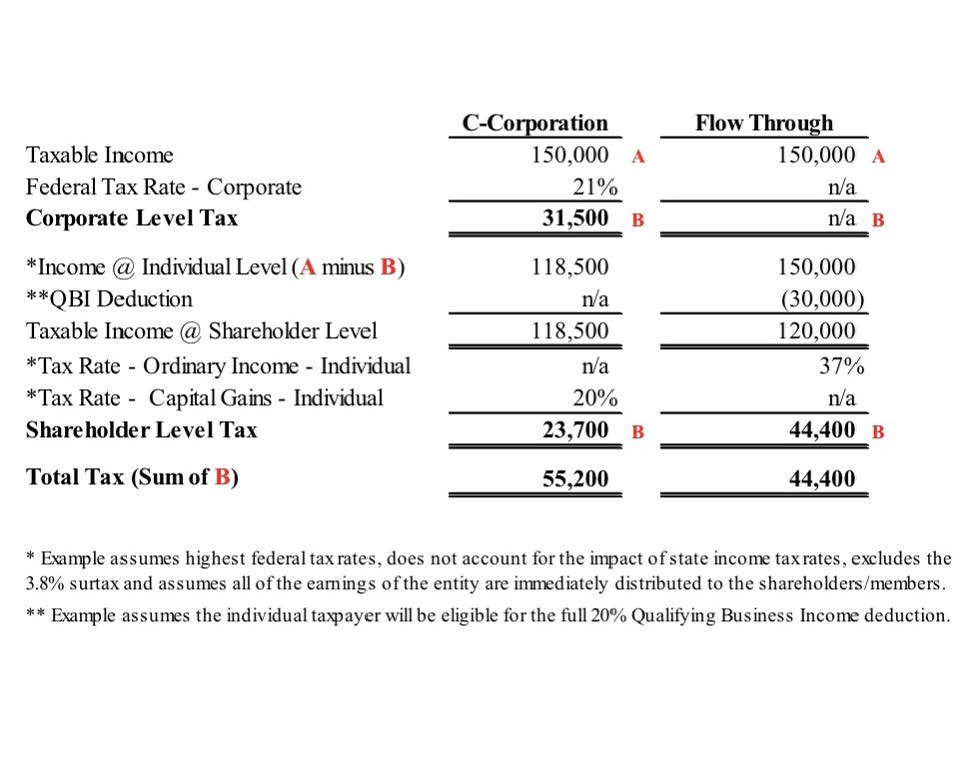

Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. Converting your S corporation to an LLC takes careful planning and a detailed knowledge of both business entity law and the Tax Code.

For advice and counsel that can reliably help you. Appointment at 201 208-2200. We dont make judgments or prescribe specific policies.

For C corporations the current accumulated retained earnings threshold that triggers this tax is 250000. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. QTRX Accumulated other comprehensive income loss as of today September 26 2022 is -22 Mil.

C corporations may accumulate earnings up to 250000 without incurring an accumulated earnings tax. Code 532 - Corporations subject to accumulated.

Oh How The Tables May Turn C To S Conversion Considerations Stout

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

Determining The Taxability Of S Corporation Distributions Part Ii

Earnings And Profits Computation Case Study

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

Will C Corporations Be The Comeback Kid Of 2018

Is Corporate Income Double Taxed Tax Policy Center

Earnings And Profits Computation Case Study

What Are Accumulated Earnings Definition Meaning Example

What Are Retained Earnings Guide Formula And Examples

Earnings And Profits Computation Case Study

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company